Updates from River Horse & Boaks Beer

A quick post with some updates (no more tax talk for a change).

We caught up with Glenn Bernabeo from River Horse last weekend at the beer and barbecue festival at WXPN in Philadelphia (a shout out to the Pobutkiewicz brothers, Dave and Russ, for sharing a surplus ticket). Between pours of RH Belgian Double Wit and a new beer with molasses, Glenn gave us an update on what’s been going on at the Lambertville operation. (Some points he made confirm plans we’ve noted in the past. Also, sorry for the photo quality; iPhones are cool, but a digital SLR camera they are not, especially in low light.)

Between pours of RH Belgian Double Wit and a new beer with molasses, Glenn gave us an update on what’s been going on at the Lambertville operation. (Some points he made confirm plans we’ve noted in the past. Also, sorry for the photo quality; iPhones are cool, but a digital SLR camera they are not, especially in low light.)

If you liked RH’s double IPA, Hop-a-lot-amus, it’s coming back around in bottles. Soon. RH released it draft-only back in the fall. Look for the next iteration, with ramped-up hop aroma, to hit the shelves in April (that’s when their Summer Blonde Ale comes out as well).

In early May, RH will release another Brewer’s Reserve, this time a rye hefeweizen, aptly called Hefe-rye-zen (we think that’s how it’s spelled, or something close). RH’s Brewer’s Reserve series has done well for them, notably their first one, Belgian Double Wit, which debuted a year ago and quickly earned a spot in the regular lineup. One of the more recent reserve series beers, an oatmeal milk stout, was quite popular, too; it’s scheduled to come back in October.

Also returning is Dunkel Fester, a big hit of a dark lager that was draft only last year. It’s in bottles in August (a long wait for Fester and the stout's return, but it will be worth it; trust us.) Along the way, you’ll see pumpkin spice in Tripel Horse, Glenn says.

And here’s a cool one, draft-only, but damn, seems like when RH says draft only, things end up available in bottles pretty quickly afterward. Glenn says the brewery is observing Philly Beer Week (it starts this Friday and runs through the 15th) with Dubbel Honey Weizenbock. It's been specially brewed for PBW. You can try it at the Philly Craft Beer Festival at the Cruise Ship Terminal at the Navy Yard this Saturday, or at the Fair Food/White Dog Foundation Brewer’s Plate food-and-beer pairing on Sunday, held this year at the Penn Museum (at U Penn, of course), a popular spot for beer functions, to say the least.

Here’s RH’s tasting notes on the Lenten wheat bock: Munich and caramel malts up front, rounded out by orange blossom honey, clocks in at 7.5% ABV. We're looking forward to it. Meanwhile, we also caught up with Brian Boak of Boaks Beer/Boak Beverage yesterday.

Meanwhile, we also caught up with Brian Boak of Boaks Beer/Boak Beverage yesterday.

If you recall, Brian contracted with High Point Brewing in Butler to brew his flagship Russian imperial stout, Monster Mash (10% ABV), and a lineup of Belgian beers. Monster Mash and the Belgian dubbel Two Blind Monks (7.4% ABV) will be at the craft beer fest and the Brewer’s Plate, plus PBW bar events, including the Grey Lodge, on Monday and Tuesday.

To be sure, Brian’s runs a small operation, relying on High Point to work his beers into their brewing schedule wherever they can. That's not necessarily an easy thing, since High Point also does contract brewing for the folks who own the sister restaurants of Trap Rock.

Brian's found a lot of success with his beer in eastern Pennsylvania and expects to be selling his beer in the Pittsburgh area in May or June. Not bad for a guy who has had hand-labeled case after case of bottles and hauled keg after keg to his Pa. distributor in his white Boaks Beverage van. And there's a change on the horizon for him. By mid-April, a 30-barrel fermenter that Brian had custom-made in China (for about 19 grand) is expected to be installed at High Point. That will give his brews some much-needed dedicated fermenting space. Pretty cool for him, we say.

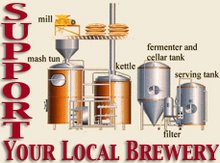

And there's a change on the horizon for him. By mid-April, a 30-barrel fermenter that Brian had custom-made in China (for about 19 grand) is expected to be installed at High Point. That will give his brews some much-needed dedicated fermenting space. Pretty cool for him, we say.