|

Senator Robert Menendez notes some

accomplishments of Flying Fish

after touring the brewery on Monday |

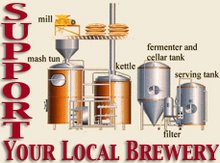

Flying Fish toasted its year-old Somerdale facility with a visit from U.S. Senator Robert Menendez, whose tour of the brewery on Monday was also the highlight of a soft opening of Flying Fish's new tasting room and the bottle release of its hurricane fundraiser beer, FU Sandy.

Senator Menendez, a co-sponsor of legislation to cut federal excise taxes for craft brewers by as much as half, took a brief tour of Flying Fish's brewery space, checking out some firkins and wooden barrels at the foot of towering fermenter tanks. He then raised a pint of Flying Fish Farmhouse Ale with company president Gene Muller and sales director Andy Newell in the new 10-tap tasting room.

|

From left: Andy Newell, Gene Muller,

and Senator Robert Menendez |

The senator saluted 17-year-old Flying Fish as a groundbreaker in the state, noting the brewery's growth since its move last year from its founding location of Cherry Hill, and saying: “It’s the first microbrewery here in southern New Jersey, and the first new brewery in the region in more than half a century. The $6 million expansion in 2012 has enabled Flying Fish to triple production and create two dozen new jobs.”

There's more growth ahead: Flying Fish has two more 150-barrel tanks coming later this month.

Last May, Senator Menendez

highlighted the introduction of the federal legislation to cut the excise tax on craft breweries from $7 a barrel to $3.50 on the first 60,000 barrels of beer produced, a reduction that would actually make the federal tax slightly lower than New Jersey's tax on craft beer production. (Others from New Jersey's congressional delegation who are supporting the measure include Reps. Rush Holt and Leonard Lance.)

Meanwhile, Flying Fish's new tasting room opened quietly on either

side of the Fourth of July holiday for growler fills and sales of six-packs and of the limited-release bottled FU Sandy.

Joe Torres, who recently joined Flying Fish to run the brewery's tasting room, says a total of 109 growlers were sold last Wednesday and Friday, plus nine cases of Sandy, the wheat-pale ale first brewed last winter to raise money for Hurricane Sandy relief efforts.

Initially draft-only, FU Sandy sold out effortlessly and was brought back with a draft release in June and 750-milliliter bottles that began hitting store shelves early last week.

Flying Fish's tasting room is still somewhat a work in progress: Some wallboard still needs to be hung, and the air-conditioning is getting a tweak. Thus, the soft opening. (Check with

the brewery for tasting room hours; by the way, Flying Fish has logo'd growlers.)

•••

|

| Casey on brewhouse steps |

It's been several weeks since former head brewer Casey Hughes left Flying Fish for Tampa, Florida, and Coppertail Brewing, a start-up brewery of similar size to his New Jersey alma mater. But Casey, an avid fisherman, didn't leave without sharing a one-that-got-away tale, specifically, a beer with a Garden State-crop ingredient whose brewing eluded him during his 10-year tenure.

"Cranberry Berliner weiss. It's a style, being in the state of New Jersey, the one beer I've always said I wanted to make," Casey says. "That was the beer. I love Berliner weiss, and I'd love to do one down in Florida. It seems now that everyone brews Berliner weiss in Florida. The state seems to have really (glommed) onto that style, so I probably won't be able to do one for a while until it all calms down there."

Here in New Jersey, Casey says, "somebody else will get to make that beer."

Initially draft-only, FU Sandy sold out effortlessly and was brought back with a draft release in June and 750-milliliter bottles that began hitting store shelves early last week.

Initially draft-only, FU Sandy sold out effortlessly and was brought back with a draft release in June and 750-milliliter bottles that began hitting store shelves early last week.